Rick Neighbors, Democratic Candidate for Congress in Alabama’s District 4: Facebook

By Trace Thompson –

Rick Neighbors, a candidate for Congress in Alabama’s District 4 in North Alabama, called on Alabama’s Attorney General Steve Marshall to join 25 other state attorneys general in calling on the U.S. Department of the Treasury to take immediate action to ensure billions of dollars in emergency stimulus payments authorized by Congress go directly to American families and not debt collectors.

“I urge the Attorney General of Alabama to support the bipartisan efforts of the Attorney General of Maryland and 25 other states to ensure emergency stimulus payments go to the economic relief of families and not debt collectors,” Neighbors said in a statement. “The intent of Congress is clear in its aim to provide for the needs of the individuals and families struggling through these difficult times”.

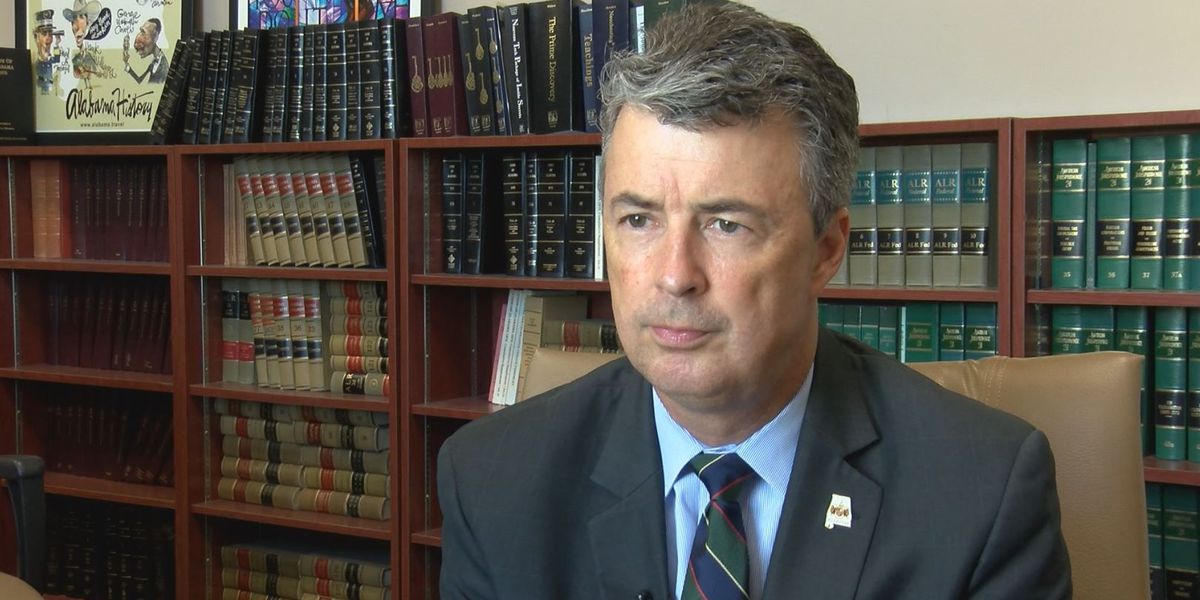

Alabama Attorney General Steve Marshall: WSFA 12 News

Neighbors is a veteran with years of management experience in the apparel industry, but mostly he’s a concerned citizen who cares so much about the people of his community in North Alabama that he’s running for Congress as a Democrat to change things in Washington, according to his campaign manager, Lisa Ward.

“As a private citizen he’s working on finding solutions during the coronavirus crisis,” she said, “leadership needed in the nation’s capital at this critical time.”

Maryland Attorney General Brian E. Frosh joined a bipartisan coalition of 25 attorneys general this week in calling on the U.S. Department of the Treasury to take immediate action to ensure billions of dollars in emergency stimulus payments authorized by the CARES Act go to American families and not debt collectors in the form of garnishments.

Congress passed the CARES Act three weeks ago to provide direct and immediate economic relief to all individuals and businesses affected by the coronavirus disease 2019 (COVID-19) public health crisis, but — unlike other government programs — the CARES Act does not explicitly designate these emergency stimulus payments as exempt from garnishment by creditors.

In a letter to Treasury Secretary Steven Mnuchin, the coalition asked the agency to protect CARES Act funds, like other government relief programs, and ensure funds are protected from wage garnishment.

“Millions of Americans are left jobless, unable to pay rent or provide for their families due to this unprecedented worldwide pandemic,” Frosh said. “The CARES Act payments were meant to benefit American families directly in meeting their immediate, most pressing needs, not to provide funds to debt collectors.”

The CARES Act authorizes the Treasury Department to issue emergency stimulus payments of up to $1,200 for eligible adults and up to $500 for eligible children.

Similar government relief programs intended to provide for Americans’ basic needs — like Social Security, disability, and veterans’ payments — all are statutorily exempt from garnishment, a legal mechanism that typically involves the “freezing” of funds in a bank account by creditors or debt collectors.

However, the CARES Act does not explicitly designate these emergency stimulus payments as exempt from garnishment, allowing debt collectors to potentially benefit before consumers.

In the letter to Secretary Mnuchin, the coalition urges the secretary to use his authority under the CARES Act to stave off economic uncertainty for millions by immediately issuing regulations or guidance explicitly designating CARES Act “benefit payments” as funds that are exempt from garnishment.

“During this public health and economic crisis, the states do not believe that the billions of dollars appropriated by Congress to help keep hard-working Americans afloat should be subject to garnishment,” the attorneys general wrote. “Treasury has stated that ‘in the weeks immediately after the passage of the CARES Act, Americans will see fast and direct relief in the form of Economic Impact Payments’.

“We request Treasury’s assistance in ensuring Americans are able to retain that monetary relief,” he said.

Attorney General Frosh joins the attorneys general of California, Colorado, Delaware, Hawaii, Illinois, Iowa, Maine, Massachusetts, Michigan, Minnesota, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oregon, Pennsylvania, Rhode Island, Vermont, Virginia, Washington, and Wisconsin, as well as the Hawaii Office of Consumer Protection in signing the letter to the Treasury Department.

Ironic, is it not, that when Wall Street, greedy bankers, hedge fund managers, etc. brought the nation to virtual collapse-and were almost immediately bailed out-they didn’t have to worry about any similar issue! Have “we” ever pondered why the working man/woman are always the VILLAIN? When working folk ban together to secure pensions after long years of service-that somehow is bad; but, when politicians get immediate pensions after just a few years of “service” that is somehow acceptable. When working folk can’t afford medical insurance and are denied medicare expansion, because the GOP feels healthcare is not a human right; but at the same time-ALL politicians receive socialistic (like veterans) medical services no one else is apparently entitled to receive? Go figure.